Interval Accumulator

$0.00

Are you seeking a smart, systematic, and risk-managed investment approach in the dynamic cryptocurrency market? The DCA Interval Accumulator strategy is a powerful and automated solution that leverages the principle of Dollar-Cost Averaging (DCA) to help you invest in your chosen cryptocurrencies regularly at predetermined intervals in the spot market.

Introducing the Automated Dollar-Cost Averaging (DCA) Interval Accumulator Investment Strategy for the Cryptocurrency Market

Are you seeking a smart, systematic, and risk-managed investment approach in the dynamic cryptocurrency market? The DCA Interval Accumulator strategy is a powerful and automated solution that leverages the principle of Dollar-Cost Averaging (DCA) to help you invest in your chosen cryptocurrencies regularly at predetermined intervals in the spot market. The goal of this strategy is to mitigate the effects of high market volatility and establish an average purchase price over time.

Understanding Dollar-Cost Averaging (DCA):

The DCA method is an investment strategy where a fixed amount of capital is allocated to purchase a specific asset periodically at set intervals (regardless of the current asset price). Instead of attempting to time the market and buy at the “best” price, this approach helps investors buy at various price points on average, reducing the risk of investing a lump sum at a high price.

How the DCA Interval Accumulator Strategy Works in the Cryptocurrency Market:

This strategy automatically executes a spot buy order of a fixed size in your selected cryptocurrency trading pair at specified intervals (daily, weekly, or monthly) based on your settings. By consistently implementing this process, you gradually accumulate assets at different price levels, averaging out your purchase cost over time. This can be particularly beneficial in the volatile cryptocurrency market, helping to reduce risk and potentially achieve more stable investment outcomes.

Comprehensive Features of the DCA Interval Accumulator Strategy:

-

Automated Investing Without Constant Monitoring: Once the strategy is set up, there’s no need for continuous market monitoring or manual trade execution. The strategy automatically performs buys for you at the scheduled times.

-

Flexible Interval Selection: You can customize the frequency of your purchases based on your preferences and investment strategy:

- Daily: A buy order is placed at the close of each daily candle. This setting is suitable for short-interval investing.

- Weekly: A purchase is made on a specific day of the week (configurable by you) at the close of that day’s daily candle. This option is suitable for medium-interval investing.

- Monthly: A purchase occurs on a specific day of the month (configurable) at the close of that day’s daily candle. This setting is ideal for long-term investing with longer intervals.

-

Fixed Investment Size in Quote Currency: You specify a fixed amount of the quote currency (e.g., USDT in the BTC/USDT pair) to be invested in each purchase. This ensures that you buy a smaller amount of cryptocurrency when prices are higher and a larger amount when prices are lower, which is the core principle of DCA.

-

Focus on Spot Trading: This strategy is exclusively designed for executing spot (cash) market buys and does not create any leveraged or futures positions, completely eliminating the risks associated with leveraged trading.

-

Optimized for the Daily (1D) Timeframe: The structure of this strategy and its use of daily candle data (

request.security(..., 'D', close, ...)) make it an ideal choice for execution on the daily timeframe. Buy decisions are made at the end of each day based on the closing price. -

Configurable Strategy Activity Period: You have complete control over your investment timeframe by setting a start and end date for the strategy’s execution. This feature is very useful for planning long-term investments.

-

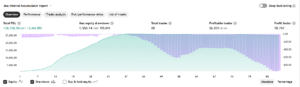

Visual Display of Trade Entries: Purchase points are marked with graphical indicators (green upward-pointing triangles) on the price chart. This helps you easily view and analyze your purchase history.

-

Partial Position Exit Option Upon Reaching Profit Target: You can set an overall profit threshold for all open positions. Once the accumulated profit reaches this level, you can specify a percentage of the total open positions to be automatically closed. This feature allows you to realize gains and manage risk.

-

Display of Key Performance Information: During the strategy’s execution, important information is dynamically displayed on the chart, including:

- Average Position Entry Price: The average price you’ve paid for all the assets purchased.

- Real-time Profit or Loss: The current profit or loss of your open positions based on the current market price.

- Total Investment Cost: The total amount you’ve spent on purchasing assets so far.

- Maximum Drawdown: The largest decline experienced from a peak in accumulated profit to a subsequent trough. This metric is crucial for assessing the strategy’s risk.

-

Automatic Closing of All Positions at the End of the Period: If you set an end date for the strategy, all open positions will be automatically closed at that time. Additionally, if the strategy is running in the present day, there’s also an option to close all positions.

Benefits of Using the DCA Interval Accumulator Strategy in the Cryptocurrency Market:

-

Reduced Risk from Market Volatility: By spreading your investments over time, you avoid trying to predict the “best” time to buy and mitigate the impact of sharp price fluctuations on your capital.

-

Disciplined Investing: This strategy helps you follow a consistent investment plan and avoid emotional trading decisions.

-

Simplicity and Ease of Implementation: Setting up and activating this strategy on the TradingView platform is straightforward and doesn’t require complex technical knowledge.

-

Suitable for Long-Term Investors: The DCA strategy is particularly well-suited for long-term investments, helping investors potentially benefit from the long-term growth of the cryptocurrency market.

Step-by-Step Usage Guide:

- Copy and paste the provided code into the Pine Script editor on your TradingView platform.

- After saving, add the strategy to the chart of your desired cryptocurrency trading pair (e.g., BTC/USDT) on the Daily (1D) timeframe.

- In the strategy’s input settings, enter your desired values:

- DCA Period (dca_period): Choose between DAILY, WEEKLY, or MONTHLY.

- Month Day (month_day): If you selected MONTHLY, enter the desired day of the month for purchases (between 1 and 28).

- Week Day (week_day): If you selected WEEKLY, choose the desired day of the week for purchases (as a number, e.g., 1 for Monday, 7 for Sunday).

- Single Operation Size in Quote Currency (dca_sigle_size): Enter the fixed amount of the quote currency (like USDT) to be invested in each purchase.

- DCA Long (dca_long): Ensure this option is enabled (true) for buy orders.

- Exit Strategy (exit_strategy): You can choose NONE (no automatic exit strategy) or GAIN THRESHOLD (exit upon reaching a profit target).

- Exit Gain Threshold (exit_gain_threshold): If you selected GAIN THRESHOLD, enter the desired overall profit amount (in quote currency).

- Exit Close Percentage (exit_close_perc): If you selected GAIN THRESHOLD, enter the percentage of open positions you want to close.

- Start Year, Start Month, Start Day: Set the starting date for the strategy’s execution.

- End Year, End Month, End Day: Set the ending date for the strategy’s execution (if you want it to run indefinitely, enter a date far in the future).

- After applying the settings, the strategy will begin executing buy orders according to your schedule.

Important Notes and Considerations:

-

The cryptocurrency market is inherently risky, and the use of this strategy does not guarantee ultimate profitability. Past performance of a strategy cannot guarantee future results.

-

Before using this strategy with real capital, it is strongly recommended to test it in a paper trading account for some time to familiarize yourself with its operation and find the appropriate settings for your market conditions and chosen asset.

-

Always consider risk management in your investments and only use capital that you can afford to lose.

-

The results of this strategy may vary depending on market conditions, the cryptocurrency being traded, and your chosen settings.

By using the DCA Interval Accumulator strategy on the daily timeframe for the cryptocurrency market, you can adopt a disciplined and systematic investment approach and potentially benefit from the long-term opportunities of this market.

Related products

DCA dragon free

Key Features:

- Customizable Sensitivity: Tailor the algorithm to fit your trading style.

- Risk Management: Utilize Average True Range (ATR) for effective trailing stops.

- Smart Signals: Get accurate buy and sell signals using Stochastic and EMA indicators.

- Visual Cues: Easily identify market conditions with color-coded signals.

- Heikin Ashi Support: Gain deeper insights into market trends.

Reviews

There are no reviews yet.